Some investments are easier to convert into cash than others. This is called liquidity. Liquid investments are assets that you can quickly sell for cash, like stocks or money market accounts. In contrast, illiquid investments are harder to sell and may take longer to turn into immediate funds.

Finding the right balance of liquid and illiquid assets can make a big difference in your investment strategy. Imagine needing cash urgently but having it tied up in real estate or private equity—you may struggle to sell quickly. By understanding which investments offer low liquidity, you’ll see how financial flexibility can impact your long-term financial planning.

Certain assets, like collectibles or real estate, fall under low-liquidity investments because they’re challenging to sell fast without losing value. While illiquid investments may have high return potential, they also limit financial flexibility in times of need. When you diversify with both high-liquidity and low-liquidity assets, you can build a balanced investment portfolio that suits your risk tolerance, profitability goals, and investor needs.

What Is Liquidity?

Liquidity is how easily an asset turns into cash. Liquid assets are quick to sell, even in big markets like the stock market. Examples of these include stocks, bonds, and money market instruments. High trading volume means active buyers and sellers, which increases liquidity. Investments like blue-chip stocks—stocks from large, stable companies—are very liquid because there’s high demand. Liquidity helps investors make choices based on their risk profile and potential returns.

Some assets are illiquid because they’re hard to sell quickly. Real estate and collectibles are common illiquid assets. Market conditions affect liquidity; fewer buyers in tough markets make it harder to sell these assets fast. Liquidity impacts an investor’s cash flow, which affects how they can use their money when needed. Financial institutions watch liquidity to handle market price stability and limit liquidity risk.

Understanding liquidity is key for investment decisions. Highly liquid assets are easier to trade, making them safer in uncertain markets. Financial markets rely on liquidity, especially in assets like Treasury bills (T-Bills) and corporate bonds. Market participants value liquidity metrics like time to sale because they reveal how quickly an asset might convert to cash. Liquidity helps keep financial systems balanced and efficient.

Factors Affecting Liquidity

Market Demand and Supply

Market demand and supply affect how quickly an asset can be bought or sold, known as liquidity. When there are more buyers and sellers, it’s easier to trade an asset, making it more liquid. Economic principles show that high demand and low supply can increase liquidity, while low demand and high supply can reduce it.

Market Conditions

Market conditions affect liquidity in the financial world. During times of economic uncertainty or financial crises, liquidity can drop as fewer people buy and sell assets. This makes it harder for investors to quickly sell investments.

In uncertain markets, investors often act with caution. Market volatility can cause sharp changes in liquidity, and liquidity challenges may increase in downturns. Investors plan carefully to manage their assets during these times.

Transaction Costs

Transaction costs are the fees for buying and selling an asset. These include brokerage fees that investors pay during each trade. High transaction costs can make trading expensive, affecting how often investors buy and sell assets.

When transaction costs are high, trading activity tends to decrease, lowering liquidity in the market. Investors may avoid trading frequently to save money, which impacts overall market liquidity and influences their investment decisions.

Regulatory Environment

The regulatory environment includes government regulations that control trading activities. These rules impact how easily assets can be bought and sold, which affects liquidity in the market. When regulations are strict, trading may slow down.

Stringent regulations can limit market ease by adding more steps to asset transactions. Government influence shapes how investors can trade, impacting liquidity and the overall ease of buying and selling.

Asset Type

Different asset types have different liquidity levels. Stocks from large, well-established companies are usually more liquid, meaning they are easier to buy or sell quickly. Smaller company stocks often have lower liquidity.

Government bonds are generally more liquid than corporate bonds. Asset liquidity can vary, and the size or stability of a company often affects how easily its stocks trade in the market.

- Related Blog” Business With Apartment Above

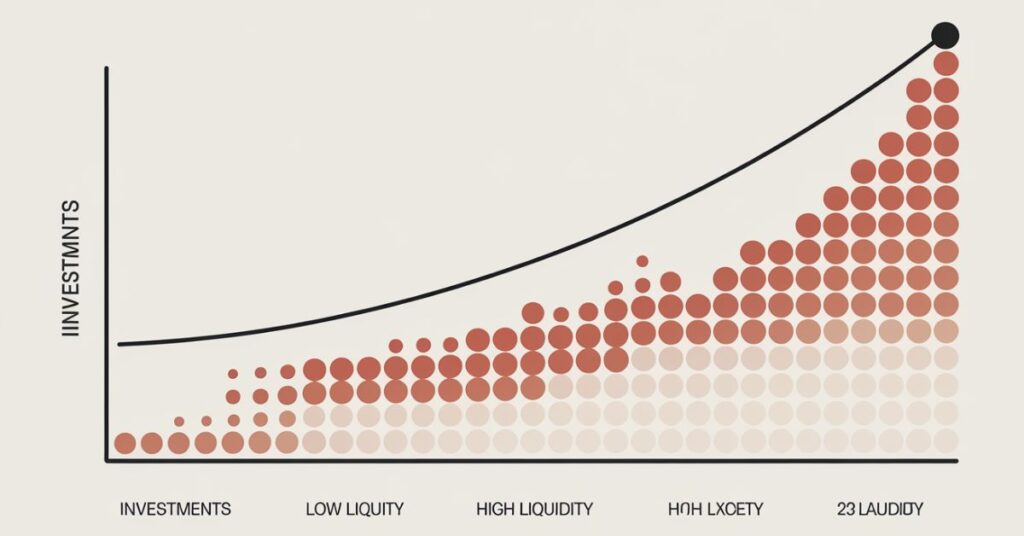

The Spectrum Of Liquidity In Investments

The spectrum of liquidity in investments shows how easily different assets can be converted into cash. Liquidity means accessibility and convertibility into cash. Some investments are very liquid, like stocks and bonds. These assets trade on major exchanges, allowing for real-time market prices. High trading volume helps make these investments easy to buy and sell. This flexibility gives investors cash when they need it.

Liquid investments include government-backed bonds and corporate bonds. These bonds usually have good liquidity because they are reliable and widely accepted. Many investors choose these bonds for their stability. They know they can sell them quickly if necessary. Exchange-traded funds (ETFs) also fit into this category. They offer a mix of stocks and bonds, making them easy to trade on the stock market.

Other assets fall into the category of semi-liquid investments. One example is real estate properties. These assets are not as easily converted to cash as stocks or bonds. Market conditions can affect how quickly a property sells. The maturity periods of investments also play a role. Investors may wait longer to see a return on their real estate.

Lastly, there are illiquid investments. These include hedge funds, private equity, and venture capital. Illiquid assets are harder to sell quickly. They often come with lock-up periods, meaning investors cannot cash out for a set time. The value of these assets can appreciate over time, but their marketability is limited. Art and collectibles are other examples of illiquid investments. Their desirability and market demand can vary, impacting liquidity. Understanding the spectrum of liquidity helps investors choose the right assets for their goals.

Different Non-Liquid Assets

Non-liquid assets are investments that are not easy to convert to cash quickly. Examples include real estate, private equity, and venture capital. These assets offer greater returns, but they also come with higher risks. Investors must be aware of these trade-offs when choosing their investments.

These illiquid investments have lower liquidity and can take a long time to sell. The sale duration depends on market demand and trading volumes. Investors with a higher risk appetite may choose non-liquid assets to meet their financial goals. Understanding liquidity is essential for making informed investment decisions and balancing risk with potential rewards.

Private Equity Investments

Private equity investments involve putting money into private companies that are not publicly traded. Investors typically commit for 5 to 10 years. These investments are considered illiquid, meaning they cannot be easily sold. Investors buy shares in non-publicly traded firms, which are not listed on public stock exchanges.

The goal of private equity is to help improve these companies and achieve high returns. An exit event occurs when the company goes public through an Initial Public Offering (IPO) or gets acquired. Institutional investors and high-net-worth individuals often participate in private equity. These investments require a long-term commitment and a higher minimum investment but can lead to significant gains over time.

Venture Capital

Venture capital is money invested in startups with high growth potential. It is a type of investment that requires a long-term perspective. Investors provide funds to help these companies grow and succeed. They expect their investment to pay off later.

These investments often have lock-up periods, meaning investors cannot sell for a while. An exit strategy is important. Successful exits happen when a startup goes public through an Initial Public Offering (IPO) or gets acquired by a larger company. However, venture capital can be risky because it involves illiquid investments in uncertain markets.

Real Estate Investment

Real estate investment involves buying properties to make money. The type of property and location greatly affect its value. Residential properties in prime locations sell faster than those in less desirable areas.

Liquidity can vary in real estate. It may take time to sell properties due to market conditions and transaction processes. Investors must consider capital outlay and regulatory approvals before investing. These factors impact how quickly they can sell a property and get cash back.

Art and Collectibles

Art and collectibles are unique items that can be valuable investments. Their liquidity depends on market trends and desirability. An accurate appraisal helps determine their worth. The value of art is often subjective, meaning it can change based on what buyers want.

Selling art can take time due to its illiquid assets nature. The selling period varies, influenced by the number of interested buyers. Collectors play a big role in shaping market value. If an item has significant appreciation, it may become more desirable, making it easier to sell.

Gold And Silver

Gold and silver are popular safe-haven assets that investors use to protect their money. Physical gold and physical silver are less liquid, meaning they can be harder to sell quickly and require secure storage.

For higher liquidity, investors may choose gold ETFs and silver ETFs. These tradeable securities are easier to sell in the market. Gold and silver are valuable, but the choice between physical metals and ETFs depends on an investor’s needs for liquidity and secure storage.

Certificates Of Deposit (CDs)

Certificates of Deposit (CDs) are savings products offered by financial institutions. They have a fixed interest rate and a set time period or tenure. CDs offer a return guarantee but have low liquidity. Early withdrawal may lead to penalties, so it’s best suited for long-term savings.

Exotic Cryptocurrencies

Exotic cryptocurrencies are lesser-known digital currencies compared to major cryptocurrencies like Bitcoin and Ethereum. They often face illiquidity issues and limited marketability. Cryptocurrency exchanges may have fewer buyers for these assets, making them harder to trade.

Retirement Accounts

A retirement account like a 401(k) or IRA offers benefits for future savings but has low liquidity. Early withdrawals can result in penalties and tax liability. These accounts encourage long-term savings, limiting easy access to funds. Planning carefully helps manage low-liquidity investments in retirement.

Savings Bonds

Savings bonds are low-risk investments backed by the government, making them secure but less liquid than stocks. They require a maturity period and have a minimum holding period before cashing in. Their transferability is limited, making them ideal for long-term financial security.

Fixed Annuities

Fixed annuities are contracts with insurance companies offering a minimum interest guarantee. They have low liquidity due to surrender charges for early withdrawals, which can apply over a set duration. These are long-term investments with liquidity limitations, making them suitable for stable financial planning.

Limited Partnership Interests

Limited partnerships offer high returns and tax benefits, but they are illiquid investments due to strict exit terms and conditions outlined in the partnership agreement. Investors need a long-term commitment, as exiting can be complex. This structure suits those seeking high returns while managing liquidity challenges in financial planning.

- Related Blog” Is Hamrick’s Going Out of Business?

Low Trading Volume Securities

Low trading volume securities often include stocks from smaller companies or less popular stocks, making them low-liquidity investments. With fewer buyers and sellers, these securities can experience high price swings due to limited demand. Investors should be cautious of price volatility and liquidity challenges in these low-volume investments.

Commodity Investments

Commodity investments involve futures contracts or physical commodities like metals and grains. Futures contracts offer more liquidity, while physical commodities may face logistical challenges and longer selling times. Investors should consider market demand and time constraints when investing, as liquidity varies significantly between tangible commodities and futures.

Treasury Notes

Treasury notes are medium-term securities issued by the government with a maturity period of two to 10 years. They are low-risk investments with government backing but offer low liquidity compared to savings bonds. Treasury Inflation-Protected Securities (TIPS) provide extra security by adjusting for inflation, ideal for risk-averse investors seeking stability.

The Benefits And Risks Of Illiquid Investments

Illiquid investment opportunities can offer key advantages, like higher potential returns. However, they also present challenges, such as low liquidity and longer selling times. Investors must use robust investing strategies to align these assets with their financial goals and risk tolerance.

Potential for Higher Returns

which investment has the least liquidity, including real estate and private equity. Learn about risks, returns, and strategies for illiquid assets.

Illiquid assets have the potential for higher returns compared to liquid assets. These investments often require a long-term nature, allowing for value appreciation over time. Investors may face additional risks and inconvenience when holding these investments. However, the rewards can be significant if they are willing to wait for their investments to grow. Understanding the trade-offs of liquidity helps investors make better financial decisions.

Reduced Market Volatility Impact

Illiquid assets tend to have a reduced market volatility impact. They do not trade as frequently as liquid assets, which means their values are less affected by short-term market fluctuations. These investments are more resistant to daily price swings and market sentiment. As a result, holding illiquid assets during volatile times can help preserve long-term value, making them a stable choice for investors seeking less risk.

Long-Term Investment Horizon

Illiquid investments are best for those with a longer time horizon. These assets typically appreciate in value over an extended period. Investors benefit from the compounding effect, which increases returns over time. This strategy works well for patient investors who can hold their investments and wait for growth. Understanding the potential for long-term appreciation is crucial for effective financial planning and maximizing return accumulation in illiquid assets.

Income Generation

Illiquid assets can provide strong income generation for investors. Private equity and real estate are examples that offer regular income through dividends, interest, and rental income. These investments create a steady cash flow, helping investors achieve financial stability. Understanding how to generate income from illiquid assets is essential for building wealth over time. By focusing on these income streams, investors can improve their financial health while managing their investment strategies effectively.

Inflation Hedge

Illiquid assets like real estate and infrastructure can serve as effective hedges against inflation. These investments often maintain or increase their value during inflationary periods. As prices rise, the purchasing power of money decreases. By holding illiquid assets, investors can preserve their purchasing power over the long term. These assets appreciate in value and can provide financial stability when inflation affects other investments, making them important for a balanced portfolio.

Diversification

Diversification is important for a strong investment portfolio. By including illiquid investments like real estate, private equity, and art, investors can hedge against market volatility. These assets behave differently from traditional securities. They help protect the portfolio from sudden price movements. Adding illiquid investments can lead to greater stability and long-term benefits. A well-diversified portfolio balances risks and improves overall performance. This strategy can enhance financial security for investors over time.

The Risk of Investing in Illiquid Assets

The Risk of Investing in Illiquid Assets includes several challenges.

- Limited Marketability: It can be hard to find buyers.

- Higher Transaction Costs: Selling these assets may cost more.

- Limited Access to Funds: Investors may not access cash quickly.

- Difficulty in Valuation: It can be hard to know the true value.

- Lack of Transparency: Information may not be clear.

Frequently Asked Question

Which Investment Has the Less Liquidity?

Investments characterized by low liquidity encompass Private Equity, Real Estate, Small-Cap Stocks, Precious Metals (such as Gold and Silver), Collectibles, and specific Cryptocurrencies, among others.

What are examples of investments known for their high liquidity?

Liquid investments comprise Bonds (both Government and Corporate), Money Market Instruments, Treasury Bills (T-Bills), Blue-Chip Stocks, and more.

What is liquidity in the context of investments?

Liquidity describes the ease and speed with which an asset can be bought or sold in the market without significantly affecting its price. It plays a vital role in financial markets, reflecting how readily an asset can be converted into cash.

Which investment has the most liquidity?

Cash and cash equivalents, such as treasury bills, represent the most liquid investments. These government-backed assets can be easily withdrawn in cash without substantial value loss. Similarly, highly traded stocks on major exchanges exhibit high liquidity because of the ease of their buying and selling.

Are investments liquid assets?

Yes, investments can qualify as liquid assets based on how quickly they can be converted into cash without substantial value loss. Common liquid investments include stocks, bonds, and money market funds.

What is not very liquid but great investments?

Illiquid investments that are considered great include real estate, private equity, and collectibles like art. While they may not be easily sold, they often provide strong long-term returns and can serve as effective inflation hedges.

Conclusion

The question of “Which Investment Has The Least Liquidity?” leads us to consider options like real estate, private equity, and collectibles. These investments can offer high returns over time but may take longer to sell. They require patience and careful planning. Investors need to understand the risks involved in low liquidity.

Choosing illiquid investments can be part of a strong financial strategy. These assets often provide steady income and help protect against inflation. They can also diversify an investment portfolio, balancing risk with potential rewards. However, investors should always do their homework and be aware of the challenges of investing in illiquid assets. Understanding these factors can lead to better financial decisions for the future.

Michael Leo is a seasoned entrepreneur with a passion for business growth and innovation. With years of experience in driving success across industries, he specializes in crafting strategies that deliver results. Michael’s expertise lies in leadership, problem-solving, and leveraging market trends to maximize opportunities. His mission is to empower businesses to reach their full potential through tailored solutions and actionable insights.