Money6x Investment Trusts are high-yield investment options focused on real estate. These trusts aim to deliver solid returns through dividends and capital growth. Like other Real Estate Investment Trusts (REITs), they invest in income-producing real estate assets but have a unique focus on yields of 6% or more. Through carefully selected properties, Money6x Investment Trusts aim to provide both stable income and long-term growth potential.

Imagine earning a steady passive income without the day-to-day work of managing properties. With Money6x Investment Trusts, investors can benefit from dividend yields that outpace most other investments. These trusts provide the potential for reliable income, allowing you to build wealth even when interest rates are low or the stock market is volatile.

Money6x Investment Trusts: Your Path to Wealth Growth is an opportunity to diversify your portfolio in a way that brings both income and resilience. By investing in real estate, these trusts aim to reduce the impact of market downturns and economic shocks. However, some use leverage to boost returns, which can magnify risks if the market declines. For investors, Money6x Investment Trusts offer a promising mix of income, stability, and growth potential in one investment.

What Are Investment Trusts?

Investment Trusts are publicly listed companies that let people invest in many different assets. They own a diversified portfolio of stocks, bonds, and sometimes real estate. These are closed-end funds, meaning they issue a set number of shares traded on stock exchanges like ordinary stocks. Investment trusts help people invest in big markets with just one purchase.

Key Features of Investment Trusts

Investment trusts come with distinct features: they provide a diversified asset portfolio, trade like regular stocks on exchanges, and frequently pay dividends, offering investors a steady income

Closed-End Structure

Closed-end structures are different from open-end funds and mutual funds. Investment trusts have a fixed number of shares. Fund managers manage these trusts with a long-term perspective. They keep a cash reserve for expenses. Unlike open-end funds, there are no daily redemptions. This structure helps maintain stability in the value of the shares for investors.

Diversification

Diversification is important in investment trusts. It means investing in a diverse range of assets instead of just one. This helps with risk reduction. If one company loses value, other investments can still do well. Without diversification, an investor relies on a single asset class, which can be risky. More variety in investments makes for a safer investment plan.

Leverage

Leverage is a tool used by investment trusts. It means they can borrow money to buy more assets. This helps them enhance returns and amplify profits. However, using leverage also comes with risks. If investments lose value, the potential losses can be greater. Investors must understand leverage well to make smart choices and avoid big losses.

Income Generation

Investment trusts create income generation through dividends. They earn money by investing in assets and then share profits with their investors. This makes them a good choice for income-seeking investors who want regular cash flow from their investments.

Active Management

Investment trusts can be actively managed by professional fund managers. These experts make important decisions about buying and selling investments. They work hard to find the best opportunities for growth. This active management helps investors get better returns on their money over time. It provides a smart way to invest in the market.

- Related Blog” Small Business Drink Monthly Sell

Understanding Money6x Investment Trusts

Money6x Investment Trusts are special funds that invest in real estate. They aim to provide high dividends and help investors earn money. These trusts focus on generating passive income for their shareholders.

Background of Money6x Investment Trusts

Money6x Investment Trusts started with an Investment Management Company that wanted to create a better way to invest. Their innovative approach focuses on creating value for investors. They use strategic asset allocation and careful risk management to help investors achieve long-term growth. This makes Money6x a strong option for those looking to earn from their investments.

Investment Strategy Overview

Money6x Investment Trusts embrace a holistic investment strategy that covers

Asset Allocation

Money6x uses a Strategic Asset Allocation Model to invest wisely. This model includes different types of investments like equities, fixed income, real estate, and alternative investments. By spreading money across these areas, diversification happens. This helps with risk reduction while aiming for maximizing returns. A balanced approach can lead to better overall investment success.

Active Management

The Trust’s Portfolio is actively managed by a team of experienced professionals. They study market trends, economic indicators, and company fundamentals. This careful analysis helps them make informed investment decisions. The goal is to adjust the portfolio for better performance. Active management can help the trust respond quickly to changes in the market.

Global Perspective

Money6x Investment Trusts look at global markets for investment opportunities. They help investors find growth in both developed economies and emerging economies. This global perspective allows the trusts to explore different markets. By investing worldwide, they can take advantage of various economic conditions. This helps to increase potential returns for investors while spreading risk.

Thematic Investing

Thematic investing is a strategy used by trusts to invest in specific themes. These themes focus on areas like technology, healthcare innovation, and sustainable energy. By choosing these themes, trusts aim for future growth. This helps investors tap into trends that can shape the economy. Thematic investing allows for targeted opportunities in industries that may grow rapidly over time.

Risk Management

A robust risk management framework helps investment trusts protect investor money. It focuses on how to monitor and mitigate potential risks in the market. By identifying risks early, trusts can take steps to reduce losses. This careful approach helps ensure the protection of investor capital. Good risk management is key to maintaining trust and confidence among investors.

Types of Money6x Investment Trusts

A selection of investment trusts tailored to various investor requirements and risk tolerances is offered by Money6x.

Equity Trusts

Equity trusts focus on capital growth through investments in stocks. They buy domestic equities and international equities to increase value. This helps investors grow their money over time. Equity trusts are popular choices.

Income Trusts

Income trusts provide a steady income stream for investors. They focus on investments in dividend-paying stocks and fixed-income securities. This helps investors earn regular payments from their investments. Income trusts are reliable options.

Balanced Trusts

Balanced trusts are investment options that combine a mix of equities and bonds. They aim for both growth and income. This helps investors achieve a balanced financial plan while managing risk.

Specialty Trusts

Specialty trusts target specific sectors and themes. They focus on areas like technology and real estate. This helps investors benefit from trends in these industries while diversifying their portfolios.

Ethical Trusts

Ethical trusts invest in companies with strong environmental practices, social practices, and governance practices. They follow ESG guidelines. This helps investors support businesses that care about people and the planet.

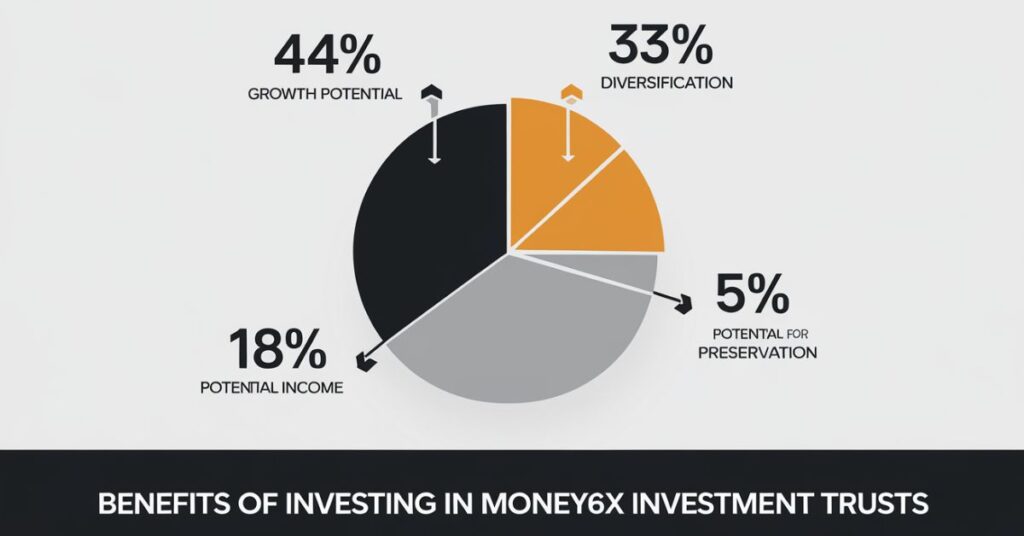

Benefits of Investing in Money6x Investment Trusts

Investing in Money6x Investment Trusts offers high dividend yields and passive income. These trusts help with portfolio diversification. They invest in income-producing real estate assets, providing a chance for steady growth and returns.

Diversification

Money6x Investment Trusts offer important benefits through diversification. One of the primary advantages is pooling funds from multiple investors. This allows for a wide array of assets to be included. By investing in different sectors and geographies, these trusts help in spreading risk. This means that if one investment does not do well, others may still perform better. Diversification helps protect investors from big losses and improves overall investment stability.

Professional Management

Money6x Investment Trusts benefit from professional management. Experienced fund managers bring their expertise to the table. They have a deep understanding of market dynamics. This knowledge helps them make informed investment decisions.

Fund managers conduct rigorous research to find the best opportunities. Investors can trust that their money is being handled by professionals who know what they are doing. This professional management helps to achieve better results for everyone involved.

Potential for Capital Growth

Money6x Investment Trusts offer the potential for long-term growth. These trusts aim for attractive returns for investors. They use an active management approach to capitalize on market opportunities. Fund managers can adjust the portfolio based on changing conditions. This flexibility helps to enhance growth over time. Investors can benefit from the careful management and strategies used by these trusts to build their wealth.

Income Generation

Money6x Investment Trusts provide regular dividends to investors. These dividends are appealing for those seeking income. Investors can choose to receive these payments or have them reinvested. When dividends are reinvested, they can create compounding growth over time.

This means investors can earn more from their investments. The regular income serves as a reliable source of cash flow, helping investors achieve their financial goals while enjoying the benefits of smart investment management.

Liquidity and Cost Efficiency

Money6x Investment Trusts offer high liquidity for investors. These trusts are publicly listed entities. This means investors can easily buy or sell shares on the stock exchange. Transactions occur at prevailing market prices. Also, they provide cost efficiency. Investment trusts usually have lower management fees compared to mutual funds. This makes them a cost-effective option for investors. They can enjoy good returns while keeping costs down. This combination helps investors manage their investments wisely.

- RELATED Blog” How To Become A Temu Influencer?

Risks Associated with Money6x Investment Trusts

Investing in Money6x Investment Trusts carries some risks. Market changes can affect their value. Economic downturns may reduce income. Investors should understand these risks before investing. Being informed helps make better choices.

Market Risk

Market risk is an important factor for Money6x Investment Trusts. The value of these trusts can change. This happens due to fluctuations in the value of underlying assets. Changes in economic conditions, interest rates, and geopolitical events can all affect market risk. Investors should be aware of these factors when investing.

Leverage Risk

Leverage can be useful for Money6x Investment Trusts. It helps to amplify returns on investments. However, there is a risk of potential losses if investments do not perform as expected. In this case, the trust may struggle to meet its debt obligations, which can affect investors negatively.

Liquidity Risk

Investment Trusts are generally liquid, meaning investors can usually buy or sell shares easily. However, during periods of market volatility, it may become difficult to sell shares quickly. This can impact the market price and may lead to selling at a lower value than expected, causing losses for investors.

Currency Risk

Trusts with international exposure face currency risk. This means changes in currency values can affect the worth of investments. When a currency fluctuates, it can impact the overall value of the trust’s investments and the returns that investors receive. Understanding this risk is important for making informed decisions.

Management Risk

Money6x Investment Trusts depend on skilled fund managers for good performance. Their expertise guides important decisions. If fund managers make poor management decisions, it can negatively affect the trust’s performance. Investors must trust the managers’ abilities to ensure their investments grow and succeed in the market.

How to Invest in Money6x Investment Trusts

To invest in Money6x Investment Trusts, open a brokerage account. Research different trusts and choose one that fits your goals. Then, buy shares through the stock exchange and monitor your investment.

Direct Investment

Investors can make a direct investment by purchasing shares in Money6x Investment Trusts. They can use a stockbroker or an online trading platform. It is important to research and understand the specific trust’s objectives and holdings before investing. This helps ensure they make informed choices for their financial goals.

Investment Platforms

Investment platforms provide easy access to Money6x Investment Trusts. They offer a convenient way to manage and monitor investments. These platforms come with various tools and resources. They help investors make informed decisions about their financial goals and strategies. Using these platforms can make investing simpler and more effective.

Financial Advisors

Consulting a financial advisor is important for investors. They help determine the best Money6x Investment Trusts for each person. Advisors align investments with financial goals and risk tolerance. They provide personalized advice to create a diversified portfolio. This guidance helps investors make smart choices for their future.

The Future of Money6x Investment Trusts

The future of Money6x Investment Trusts looks promising. These trusts aim to grow with changing markets, using smart strategies. They focus on technology and sustainability, bringing new opportunities for investors seeking stable returns

Growth Opportunities

Money6x Investment Trusts are well-positioned to capitalize on future growth opportunities. They target areas like technological advancements, demographic shifts, and global economic expansion. With innovative investments and a focus on sustainable investments, they aim to create long-term value. This approach offers investors a chance to benefit from emerging trends, supporting both stability and growth.

ESG Integration

Money6x is committed to integrating Environmental, Social, and Governance (ESG) factors into its investment decision-making process. By including ESG in their Trusts, Money6x promotes sustainable investment and responsible investment practices. This approach considers the impact on the environment, society, and company governance, aiming to create a positive influence. Money6x’s focus on ESG makes it a solid choice for those who value long-term growth and responsibility.

Technological Innovation in Investment Trusts

Advancements in technology are reshaping industries and creating new investment opportunities. Money6x Investment Trusts provides exposure to innovative companies in growth sectors such as artificial intelligence, renewable energy, and biotechnology. These sectors are expected to expand rapidly, driven by cutting-edge solutions and global demand. By focusing on technological innovation, Money6x enables investors to benefit from trends that drive long-term growth and industry transformation.

Adapting to Market Dynamics

The investment landscape is constantly evolving, and Money6x works hard at staying ahead of market trends. By adapting strategies and using a proactive approach, Money6x Investment Trusts remains competitive in changing economic conditions. This helps them respond quickly to shifts, making sure they align with the latest market insights. Money6x supports investors through adjustments that keep up with the dynamic market environment.

- Related Blog” How to Unlock M-Shwari Loan Limit from Zero

Frequently Asked Question

Are investment trusts a good investment?

Similar to other funds, investment trusts experience fluctuations in value. However, their performance is influenced by additional factors, including supply and demand, making them potentially more volatile and thus a higher-risk investment.

What are the problems with investment trusts?

One unique risk with investment trusts is mistiming purchases and sales relative to the discount or premium on Net Asset Value at those moments. Buying at a significant premium and selling at a large discount could potentially erode a substantial portion of your capital.

What bonds have a 10 percent return?

Bonds with a 10 percent return are rare and typically high-risk, such as junk bonds or emerging market bonds. Interest rates and market conditions greatly influence bond returns.

How do I choose an investment trust?

You establish a strategy for your portfolio and assess which trusts align with the asset classes and sectors you aim to gain exposure to. Next, you analyze each trust based on key factors like performance relative to benchmarks, the manager’s track record, underlying assets, and associated costs.

What are the risks of investment trusts?

A decline in net asset value can result in a loss, potentially reducing the principal investment. Any profits or losses generated from investment management are ultimately borne by the investors.

Conclusion

Money6x Investment Trusts: Your Path to Wealth Growth offers a solid opportunity for building long-term wealth. With diverse investments, including stocks, bonds, and real estate, it helps reduce risks while aiming for growth. The active management and professional expertise provided by Money6x ensure that the trust adapts to changing markets, maximizing potential returns for investors.

Money6x also promotes steady income generation and sustainable investment options, making it suitable for both income-seeking and growth-oriented investors. By balancing risk and reward, Money6x Investment Trusts help investors pursue financial goals with confidence. Investing in Money6x can be a wise choice for those looking to grow their wealth over time while benefiting from professional management and diversified assets.

Michael Leo is a seasoned entrepreneur with a passion for business growth and innovation. With years of experience in driving success across industries, he specializes in crafting strategies that deliver results. Michael’s expertise lies in leadership, problem-solving, and leveraging market trends to maximize opportunities. His mission is to empower businesses to reach their full potential through tailored solutions and actionable insights.