M-Shwari is a mobile-based banking service that offers loans to users via their phones. When your loan limit is at zero, it means you cannot borrow any money. This can happen due to a lack of activity, poor credit history, or incomplete account setup.

Unlocking your M-Shwari loan limit from zero requires following a few key steps. By understanding your credit behavior and using M-Shwari regularly, you can increase your limit. With consistent borrowing and repayments, your limit will improve over time.

In this article, we’ll explain how you can raise your loan limit from zero, guiding you through each step. If you’re looking to access quick loans, this guide will show you how to take control of your financial future.

Know M-Shwari eligibility

Eligibility for M-Shwari requires a registered Safaricom SIM card and an active M-Pesa account. At least six months of M-Pesa activity is important. Savings and credit history should also be strong to access loans.

A good credit score helps increase your chances. Consistent deposits and mobile transactions show responsible behavior. Keep the M-Pesa account updated and in use to stay eligible.

Activate M-Shwari via M-Pesa

To activate M-Shwari using M-Pesa, the USSD code *334# can be dialed on a mobile phone. Follow the steps shown on the screen to access M-Shwari. The service will be added to your M-Pesa menu.

Another way is through the SIM Toolkit app. Open it, go to M-Pesa, and find the M-Shwari option. Tap it to activate the service. Make sure the phone number is registered for M-Pesa to complete the process.

How to activate M-Shwari Account using USSD

To activate your M-Shwari account, dial *334#. Choose “Loans and Savings,” then select “M-Shwari.” Pick “Activate” and press OK to confirm.

How to activate M-Shwari Account through M-Pesa Sim ToolKit App

To activate your M-Shwari account via the M-Pesa Sim Toolkit app, open the M-Pesa menu, select “Loans and Savings,” choose “M-Shwari,” click “Activate Account,” and accept the terms.

Save consistently

Saving regularly helps in building a strong financial foundation. It can also improve a person’s credit score. With a better credit score, loan limits, like those from M-Shwari, can increase. This gives access to higher loan amounts.

Debt-to-income ratio is important when saving. Keeping it low helps in managing money well and opens up better opportunities. Consistent saving means better financial habits, which can also lead to greater loan eligibility in the future.

Increase savings gradually

Increasing savings slowly shows good money habits. This builds trust with lenders like M-Shwari. A steady saving plan helps in getting higher loan limits. With more savings, a person shows commitment to managing finances. This can lead to better opportunities for borrowing money in the future.

Avoid loan defaults

Avoiding loan defaults is very important. A clean credit history enhances your credibility with lenders. When payments are made on time, a higher credit score can be achieved. Borrowers with scores between 800 to 850 are low-risk. In contrast, those with scores of 300 to 579 are high-risk borrowers.

M-Shwari uses credit scores to determine loan limits. A lower score can affect how much money can be borrowed. Timely repayments help improve creditworthiness. By keeping up with payments, chances of increasing loan limits grow. Good habits with loans lead to better opportunities in the future.

Use M-Shwari services regularly

Using M-Shwari services regularly helps with loan limits. This means making deposits, borrowing, and saving often. Each action shows that the account is active. Lenders notice these transactions. Regular use of M-Shwari services makes it easier to get loans in the future.

Customers should activate their accounts to start using M-Shwari. By saving money and borrowing, borrowers can increase their credit score. This helps improve their chances of getting higher loan limits. Consistent activity builds trust with lenders. Trust can lead to more financial options down the line.

Build a good credit history

A good credit history is important for getting loans. It shows that a borrower can pay back money on time. To build this history, people should borrow small amounts and pay them back quickly. This creates a pattern of responsible borrowing.

Using M-Shwari can help improve credit scores. Borrowers must make sure to repay loans on time. Late payments can hurt their scores. A strong credit history leads to better loan limits. Lenders trust borrowers with a good record. This trust can open more financial doors in the future.

Monitor loan limits

Monitoring loan limits is very important. Knowing how much money can be borrowed helps with planning. Borrowers should check their limits regularly. This way, they can avoid overspending and manage their finances better.

M-Shwari reviews loan limits based on credit scores. A higher score can lead to increased limits. Keeping track of these changes is essential for making smart financial choices. Regular monitoring allows borrowers to use funds wisely. It also helps in building a positive credit history over time.

Use the lock savings account

Using the lock savings account is a smart choice. This account helps save money for future needs. It can positively influence creditworthiness. A strong credit score is important when seeking loans.

M-Shwari Lock allows users to save for a set time. This saving habit helps determine loan eligibility. A higher savings amount can lead to increased loan limits. Keeping money locked in this account shows good financial habits. It is an easy way to improve creditworthiness and secure better loan options.

Understand loan terms and conditions

Understanding loan terms and conditions is very important. These rules explain how the loan works. Knowing the interest rate helps to see how much extra money will be paid. Terms can also include payment schedules and fees.

Reading the fine print can avoid surprises later. It helps to ask questions if something is unclear. Knowing all details builds trust with lenders. This knowledge supports making smart financial choices. Understanding these rules helps borrowers manage their loans better. It also helps avoid future problems with repayments

Stay updated on policies

Staying updated on policies is very important for borrowers. Policies can change often. New rules may affect how loans work or what fees apply. Knowing these changes helps in making smart decisions. Regularly checking the lender’s website or app can provide important news.

Joining newsletters can also help keep track of updates. Information about changes in interest rates or new loan products may be included. Being informed leads to better financial choices. This knowledge helps borrowers manage their loans well. Understanding policies can also prevent problems in the future. It builds a strong relationship with the lender and promotes financial success.

Avoid early withdrawals

Avoiding early withdrawals is important for building savings. Taking money out early can hurt growth. This action can lead to lower loan limits in the future. It may affect creditworthiness too. M-Shwari’s system uses savings to determine loan eligibility.

Prioritizing growth within the M-Shwari platform is a smart choice. A strong savings record increases loan limits over time. Immediate needs can tempt some to withdraw funds. Staying focused on saving helps strengthen financial health. This approach influences M-Shwari’s algorithm positively. Savings contribute to better credit options and future loan opportunities.

Seek customer service help

Seeking customer service help is important for M-Shwari users. The customer service department can assist with any issues. They provide explanations and guidance about the M-Shwari loan limit. This support can help clear confusion and answer inquiries about services.

Users can find it beneficial to contact M-Shwari customer service. They can resolve problems quickly and efficiently. Getting help ensures a smooth experience with M-Shwari. Understanding loan limits and services can lead to better financial decisions. Don’t hesitate to reach out for assistance when needed.

Related Blog” How to Start a Handyman Business in Ontario

Understand late payment penalties

Customer service help is very important for M-Shwari users. When questions arise about loan repayments, the service team provides support. Users can ask about the 7.5% facilitation fee and how it affects their loans. Loan limits and the consequences of defaulting are also common concerns. If borrowers need help with account closure or financial burdens, customer service is there to assist.

Understanding the rollover fee is another key point. A rollover fee may apply if a loan is not repaid in 30 days or 60 days. This can impact a borrower’s creditworthiness. The Credit Reference Bureau (CRB) tracks credit facilities. Users should stay informed about their loan repayments and any related fees. Contacting customer service can provide clarity and prevent issues. Seeking help can lead to better management of loans and finances. Always ask questions to make sure everything is clear.

Why is your M-Shwari loan limit 0?

Your M-Shwari loan limit might be zero for several reasons. M-Shwari loans depend on your loan application and approval process. If your M-Pesa account is new or has low activity, this can lead to a zero limit. Loan disbursement may be denied due to a poor credit history or missed repayments. The M-Shwari limit can also be low if you have taken loans before and did not repay them on time. Limits can range from Ksh 100 to Ksh 50,000. Understanding these reasons helps you manage your loans better.

Your line has not attained the minimal M-Pesa usage duration

Your line may not meet the mandatory requirement for M-Pesa usage. An active Safaricom line is needed for at least six months to qualify for an M-Shwari loan. If your line is too new, it can lead to a zero loan limit. Loan eligibility depends on meeting this time frame.

Your line has not achieved the minimal M-Pesa transactions

Your account may not have achieved the minimal M-Pesa transactions needed for loans. Using M-Pesa services like sending money, withdrawing money, and paying bills is important. Buying airtime and using till numbers show your financial ability. Without enough activity, the loan limit can be low or unavailable.

Your line lacks M-Shwari savings

Not having M-Shwari savings can lead to a zero loan limit. The M-Shwari platform needs users to deposit money and save regularly. This helps subscribers increase their loan limit. Without enough savings, your M-Shwari account may not qualify for loans, affecting the amount you can borrow.

Your usage record of other Safaricom services is low

Using Safaricom products like voice services and data services can impact your M-Shwari loan limit. Without active usage of these services, your loan eligibility may decrease, leading to a low loan limit or even a zero loan limit. Regular use of Safaricom services helps increase your chances of borrowing.

Your line has late repayments or unpaid M-Shwari loan

Having late payments or an unpaid M-Shwari loan affects your loan limit. The repayment period is 30 days, with a penalty fee if missed. Delays lead to loan limit reduction and borrowing restrictions. Settling your active loan on time avoids these issues. Failure to meet loan terms may result in further penalties.

Your national ID number is on the CRB blacklist

If your national ID is blacklisted by the Credit Reference Bureau (CRB), you may face loan restrictions. Loan defaults cause this, leading to denied access to future loans. Lenders check your credit status before granting loans. Being on the CRB blacklist affects your ability to borrow from M-Shwari and other financial institutions.

How to increase the M-Shwari loan limit from zero

To increase your M-Shwari loan limit from zero, build a goodloan eligibility record. Saving regularly and using M-Shwari services help raise the loan limit. Loan factors like regular transactions and timely repayments improve your chances. The maximum loan limit can reach up to Ksh. 50,000, depending on your loan improvement steps.

- Use your Safaricom line regularly

Using Safaricom services regularly helps restore and increase your loan limit. Engaging in frequent M-Pesa usage, such as sending money or using Lipa Na M-Pesa, can improve your loan eligibility. Recharging airtime credit and paying for goods and services using your active Safaricom line also supports your loan limit restoration.

- Save regularly with M-Shwari

Saving regularly in your M-Shwari account helps grow your loan limit. By building strong saving habits, you increase your chances of getting a higher loan limit for future M-Shwari loans. Consistent savings lead to better financial opportunities with M-Shwari.

- Clear your outstanding loans

Paying off your outstanding loanon time helps avoid the CRB blacklist and negative listing. By clearing loans, you improve your loan limit for future mobile loans. Making timely payments builds trust and increases chances of getting a higher loan limit.

- Use a single line for your M-Pesa and Safaricom services

Using a single line for M-Pesa and Safaricom services shows good financial behavior. It improves your creditworthiness and boosts loan eligibility. Having multiple lines might lower your M-Pesa activities, affecting future loan approvals.

- Request for a loan regularly

Requesting a loan regularly builds your digital footprint and improves creditworthiness. Keeping up with early repayments and prompt payment increases your chances of getting a higher loan amount. Consistent loan access helps boost future loan offers and your financial profile.

How to check the M-Shwari loan limit

Here’s a table summarizing how to check your M-Shwari loan limit:

| Step | Action |

| 1. | Open your phone’s SIM toolkit. |

| 2. | Go to your M-PESA menu. |

| 3. | Select “Loans and Savings.” |

| 4. | Select “M-Shwari.” |

| 5. | Select “Loans.” |

| 6. | Click on “Check limit.” |

| 7. | Enter your M-Pesa PIN. |

| 8. | You will receive an SMS stating your loan limit. |

| Alternatively: | |

| 1. | Dial *234# to access your M-Pesa menu. |

| 2. | Select “Loans and Savings.” |

| 3. | Navigate to M-Shwari and choose “Check limit.” |

| 4. | You will receive an SMS with your current loan limit. |

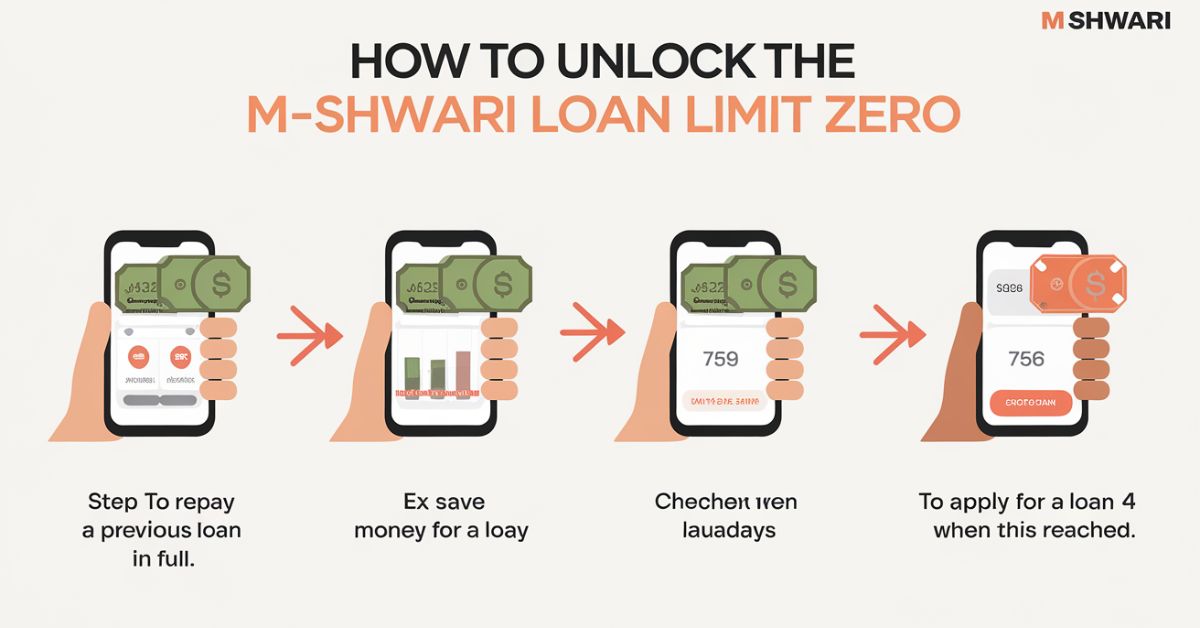

How to unlock the M-Shwari loan limit

Check your financial behavior on M-Shwari and M-Pesa

To improve financial behavior on M-Shwari and M-Pesa, focusing on responsible actions is important. Monitoring your usage on both platforms helps ensure better loan eligibility and financial growth. Some key tips include:

- Maintain a balance between loans and savings.

- Deposit savings consistently on your M-Shwari account.

- Ensure regular M-Pesa activity, including money transfers and payments.

- Keep an emergency fund for unexpected needs.

- Interest can be earned on savings to grow your funds.

- Show a positive savings track record for improved loan access.

Responsible saving and regular usage boost your chances of loan eligibility and financial stability.

Save regularly on M-Shwari

Saving more in your M-Shwari wallet can increase your loan limit, showcasing your financial discipline

Improve your loan repayment history

Timely repayment of previous loans enhances your credibility and boosts your loan limit.

Increase your M-Pesa usage

Increasing M-Pesa usage helps improve loan eligibility and boosts creditworthiness. Regular transactions also impact M-Shwari loan assessment. To enhance usage, follow these steps:

- Make more mobile payments.

- Frequently send money and buy airtime.

- Pay bills and manage expenses through M-Pesa.

- Maintain strong account activity for better loan terms.

Regular usage improves financial standing.

Keep your M-Pesa line active

Keep your M-Pesa line active, as inactivity can negatively affect your eligibility.

How can you borrow from M-Shwari?

To borrow from M-Shwari, use a Safaricom line that is registered with M-Pesa:Open your phone’s sim toolkit.

- Go to your M-Pesa menu.

- Select “Loans and Savings.”

- Select “M-Shwari.”

- Select “Loan.”

- Request Loan.

- Enter the amount.

- Enter your M-Pesa PIN

What is the maximum M-Shwari loan limit?

The maximum M-Shwari loan limit is Ksh 50,000, with a minimum of Ksh 100. Borrowers have a one-month repayment period. These loans are designed as short-term financial solutions. The loan amount depends on lending criteria and borrowing limits set by M-Shwari.

Why is your M-Shwari loan limit not growing?

Your M-Shwari loan limit might not be rising due to the following factors:

- You do not use your Safaricom line regularly.

- You do not use M-Pesa services regularly.

- You only sometimes save with M-Shwari.

- You have outstanding M-Shwari loans.

- You do not pay M-Shwari loans in time.

- You do not request M-Shwari loans regularly.

How do you pay an M-Shwari loan?

Repay your loan using M-Pesa by following these stepsGo to your M-Pesa menu.

- Select “Loans and Savings.”

- Select “M-Shwari.”

- Select “Loan.”

- Select “Pay loan.”

- Enter the amount.

- Enter M-Pesa PIN.

- Confirm the message displayed, for example, “pay loan Kshs. 2000,” then press 0K.

- An SMS message is sent on a successful or unsuccessful request.

What are the M-Shwari withdrawal charges?

M-Shwari allows free depositswith no withdrawal fees when transferring money to your M-Pesa account. There are no withdrawal frequency limits, making it a flexible service. Minimum operating balances may apply to ensure account activity. Enjoy cost-free services for bankingand mobile money transfers.

Can you send money to another M-Shwari account from your M-Shwari?

Money cannot be directly transferred from one M-Shwari account to another. To send funds, money must first be withdrawn to the M-Pesa account. Then, use M-Pesa for the money transfer. These are the banking restrictions for peer-to-peer transfers.

Can M-Shwari put you on CRB?

If you have an unpaid loan for over 120 days (4 months), you will be listed with the CRB.

Michael Leo is a seasoned entrepreneur with a passion for business growth and innovation. With years of experience in driving success across industries, he specializes in crafting strategies that deliver results. Michael’s expertise lies in leadership, problem-solving, and leveraging market trends to maximize opportunities. His mission is to empower businesses to reach their full potential through tailored solutions and actionable insights.